Check out John’s latest Brisbane Industrial Southside Sales newsletter!

It is packed with essential information to keep you informed and stay ahead in the dynamic industrial property market. Gain valuable insights into the latest trends in supply levels, vacancy rates, rental rates, yields, and more.

Despite rising vacancies and a normalization of demand, Brisbane’s industrial market remains driven by strong fundamentals, including population growth, infrastructure development, and continued demand from key sectors like logistics and transport.

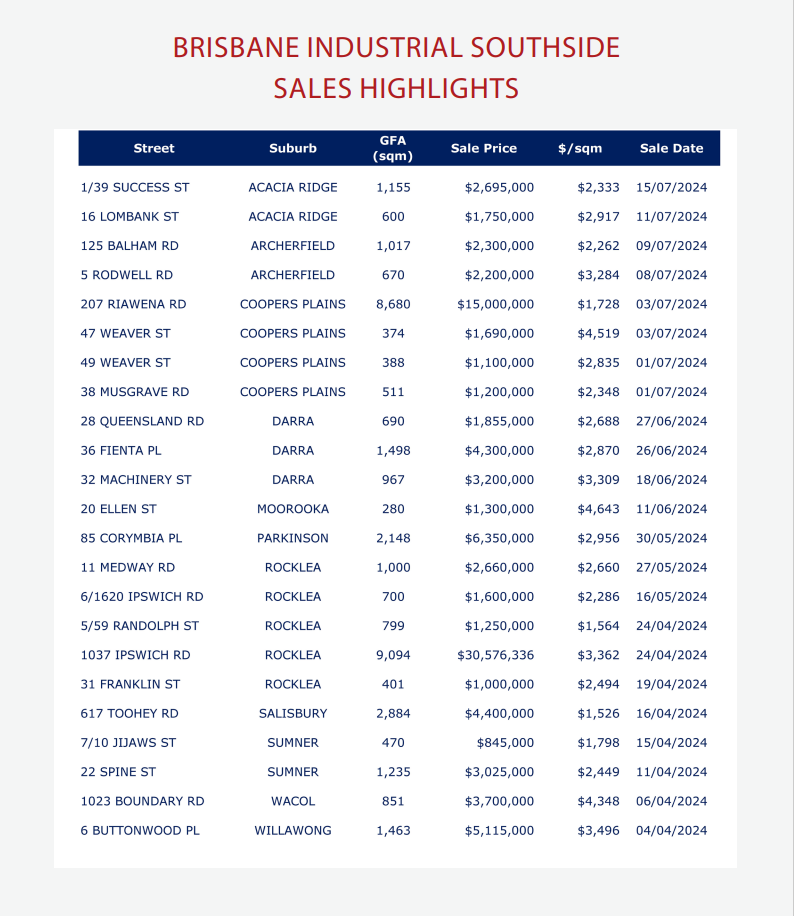

Below is a summary of key market indicators, including vacancy rates and supply, leasing activity, investment trends, and rental growth over the reporting period.

Vacancy Rates and Supply

• Vacancy rates in Brisbane’s industrial market remained stable, ranging from 2.7% to 3.38%. While slightly up from previous quarters, they remain low by historical standards.

• New completions in Brisbane contributed significantly to the national industrial pipeline, with over 40% of new development completions in Australia coming from Brisbane, particularly in the Southern Growth Corridor. Speculative development is on the rise, causing a slight increase in vacancy, but the market remains tight.

Leasing Activity

• Leasing take-up in Brisbane saw a 44% increase in the first half of the year, however has slowed in recent months. The West and South submarkets were especially active.

• Leasing demand was bolstered by speculative completions and sustained demand from the transport and logistics sectors, which accounted for a significant portion of the leased space.

Investment Activity

• Investment volumes in Brisbane grew, with $225 million in sales during the first half of 2024. Prime yields in Brisbane slightly firmed to 5.67%-6.20%, indicating continued confidence in the market.

• Major transactions included notable sales such as 347 Lytton Rd, Morningside, for $110 million.

Rental Growth

• Prime rental growth remained strong for the first half of 2024, reaching up to $180/ sqm (above 1,000sqm), however has dropped slightly in recent months.

• Incentives offered to tenants remained steady, ranging between 5% to 15%, with no significant increases despite the rise in vacancy rates.